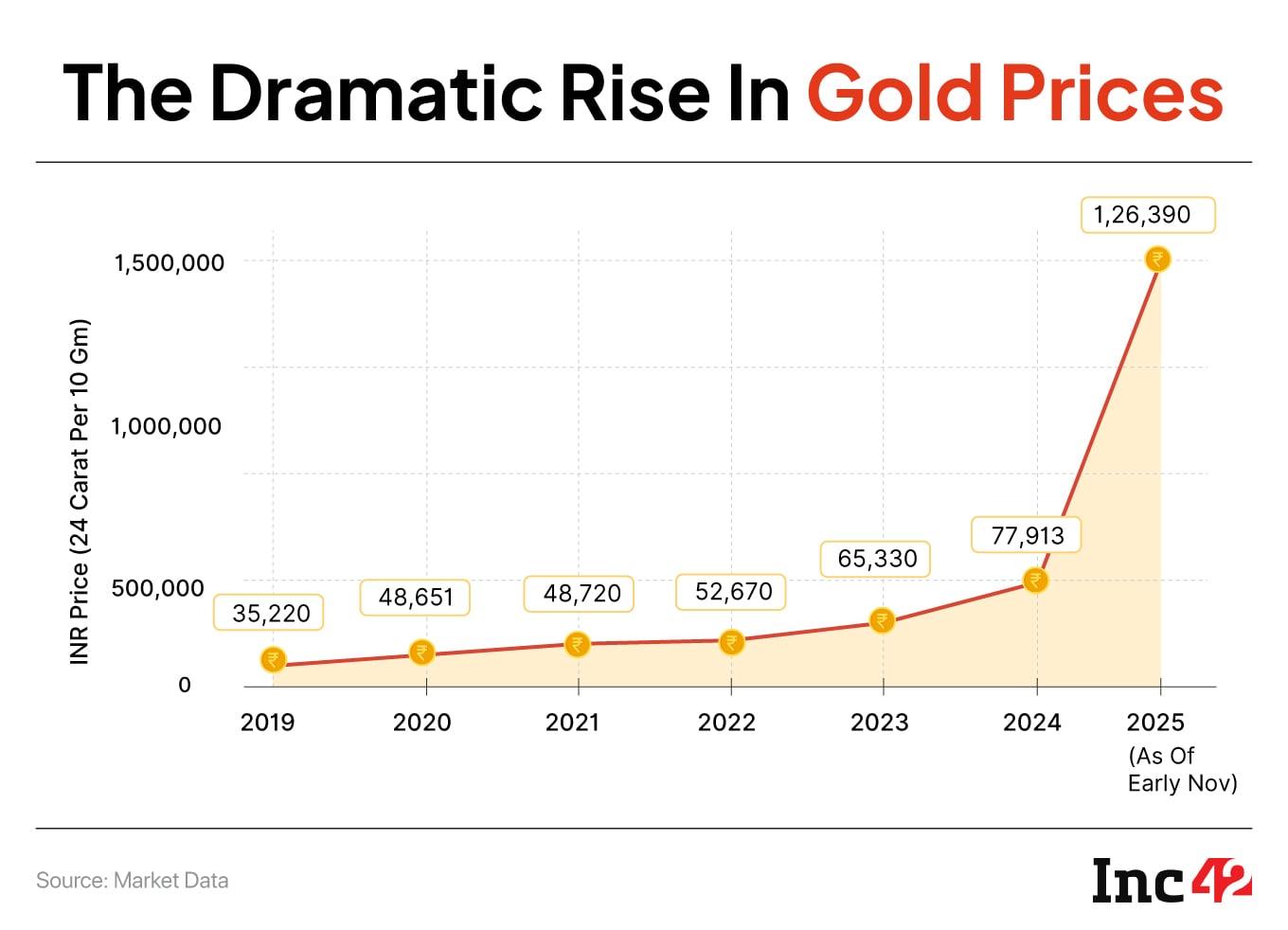

It would be an understatement to say that gold has had a remarkable year as an investment. After soaring over 57% in 2025 till October, prices briefly stabilised. On October 7, gold crossed the $4,000 mark for the first time ever, hitting an all-time high of $4,380 on October 17 before a brief 10% correction. Now, it’s again back above $4,000.

According to the World Gold Council’s Gold Demand Trends Q3 2025 report, central banks added a net 220 tonnes of gold in the third quarter alone, a 28% jump from the previous quarter.

Unsurprisingly, fintech startups are racing towards the gold rush. The likes of Paytm, Jio FInancial Services, InCred Money, Jar, DigiGold, Gullak, IndiaGold, Jupiter among dozens of others are looking to tap into the gold frenzy through digital coins. Some started before others, but the core idea behind these platforms is the same — offer consumers a way to invest in gold without them directly buying and storing gold.

InCred Money, Paytm and Jio Financial Services most recently launched major campaigns for digital gold in partnership with various regulated entities. JFS’ ‘Jio Gold 24K Days” offer even allowed customers to start investing in gold with as little as INR 10, similar to the proposition by Jar.

Even fantasy sports platforms Dream11 and WinZo have joined the bandwagon, after the ban on real money gaming, offering digital gold among other investments.

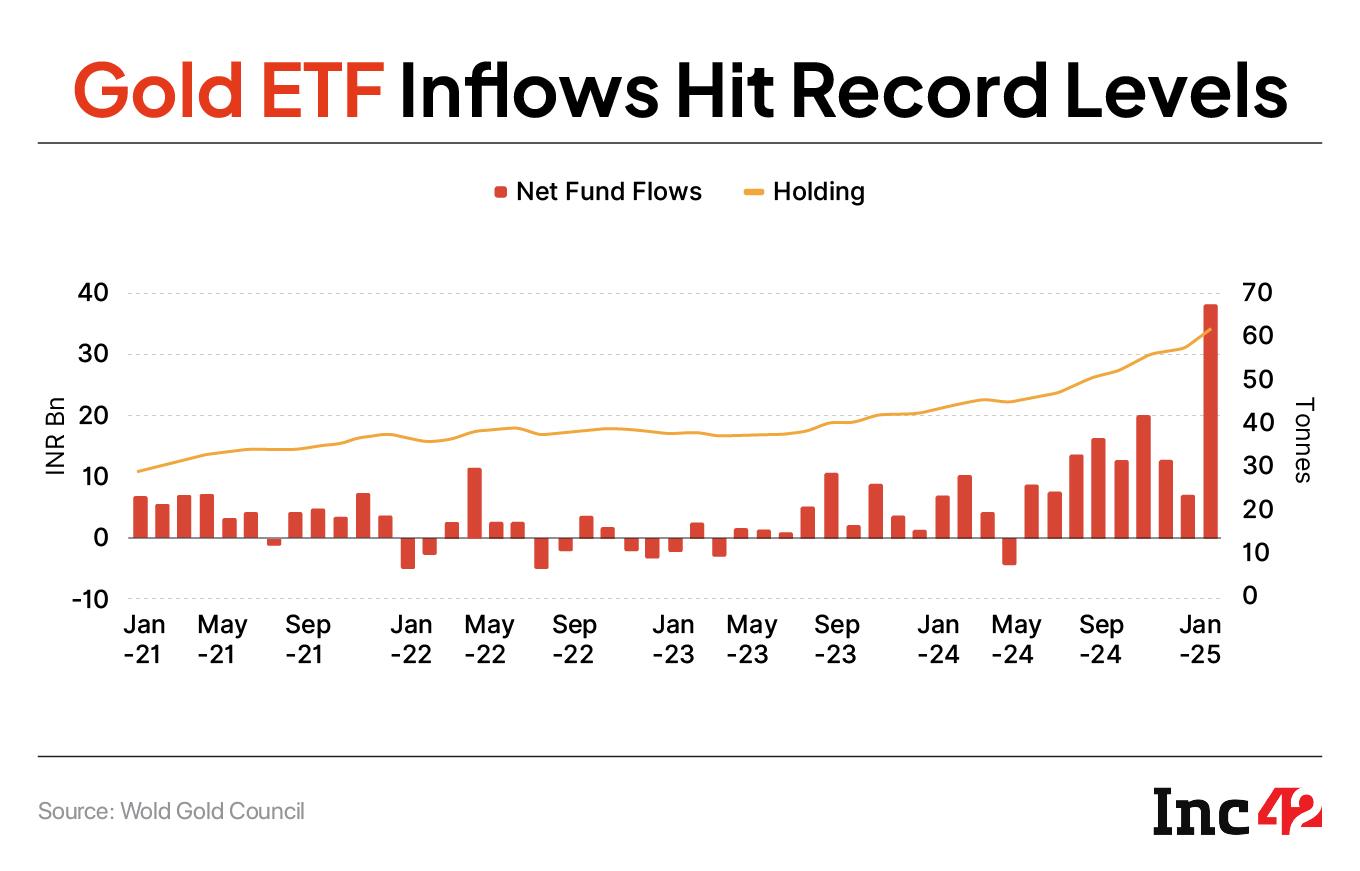

The New Gold RushAccording to fintech experts, the digital gold space is not strictly regulated, which explains why a lot of players have jumped on to this gold rush. The only regulated products are gold ETFs and electronic gold receipts (EGRs), but these are not exactly suitable for non-savvy investors.

On the other hand, digital gold as an offering is extremely enticing for customers, since it brings steady returns and has relatively no risk of actually storing gold. Platforms have made it trivially simple to invest in digital gold, with little to no friction in user onboarding.

By allowing users to buy gold for as little as INR 10, platforms create a low-friction entry point that builds a habit. This entry point can then be used to sell other products. In contrast, gold ETFs which are safer and regulated, but not as simple.

They require KYC, brokerage, and demat accounts, which adds a lot of friction for first-time or low-ticket investors. Plus, there’s the fact that most retail users don’t fully understand ETF pricing or market hours.

Digital gold solves this with a simple “buy now” button, UPI support and instant gratification. Indeed, digital gold purchases via UPI have more than doubled from 50.93 Mn to 103.2 Mn between January and September 2025.

But as with any gold rush in the past, individuals need to exercise some caution. That’s what the Securities and Exchange Board of India (SEBI) said in its advisory on November 8, 2025

Warning investors about unregulated ‘digital gold’ products, SEBI noted that several online platforms have been promoting digital gold as an “alternative to physical gold,” even though such products are neither notified as securities nor regulated as commodity derivatives.

The regulator cautioned that these offerings fall outside its jurisdiction and may expose investors to significant counterparty and operational risks. The notification comes just days after there were widespread concerns raised by investors about lapses on digital gold platforms when it came to withdrawals and delivery of physical gold.

With a whole host of startups — many joining this rush recently — operating in this space, and with investor money at stake for both VCs and individual users, does this signal more impending regulations for digital gold apps?

Globally central banks are buying record amounts of gold amid market uncertainty and currency volatility. Retail investors see the same signals. With deposit rates falling in line with repo rate cuts, gold has re-emerged as the go-to “safe” asset.

For lower and middle income segments, digital gold offers a sense of participation in the financial markets. People see gold prices rising, while deposit rates are falling because of changes in repo rates. So gold investing is a relatively cheap and risk-free option compared to stock market or other avenues.

Even for affluent customers, physical gold has become increasingly inaccessible as supply shortages are real.

During the Diwali season, for instance, many customers went to buy bullion from jewellers when there was literally no stock available. That’s another reason these digital gold assets have picked up.

In addition, for fintech startups, the unit economics of digital gold are attractive. Digital gold offers higher intermediary margins compared to mutual funds, another high engagement investment product. Pricing and spreads are less transparent, giving platforms room to optimise profitability, a fintech founder added.

“Customers also don’t fully understand the charges that are applied. They’re not as transparent as interest rates or mutual fund expense ratios. They’re a bit more opaque because pricing varies depending on when you choose to buy or sell,” the founder added.

Working In A Grey AreaBut the lure of gold is real and that’s why, despite these challenges, digital gold has boomed. In fact, it’s been promoted and marketed as an investment opportunity for just about everyone, given how the likes of Jar have lowered the price point barrier through daily gold investments.

This is precisely why SEBI’s warning matters, and indeed it has now stirred controversy around digital gold.

Industry experts reckon SEBI’s advisory isn’t about banning digital gold, but about alerting investors to the risks of operating in an unregulated zone.

While gold ETFs, exchange-traded commodity derivatives, and EGRs provide investors with structured safeguards, digital gold, on the other hand, sits in a grey area where those protections do not apply.

“When you buy digital gold, the gold is kept with MMTC or similar entities for up to six months. But many investors don’t take delivery as they just keep accumulating gold digitally. The problem starts when these companies oversell or over-leverage their stored gold,” Ram Rastogi, chairman of Fintech Association for Consumer Empowerment, said.

A few weeks ago, gold and silver prices suddenly dropped. That was partly because investors started demanding physical delivery, and companies were not fully backed by real gold. Over-leveraging the storage capacity or engaging in speculative practices is not healthy in the long term, he added.

This could very well snowball into a bigger issue if platforms do not have reserves of gold to fulfil any delivery claims made by investors in the future. It could have a drastic impact on gold prices as a whole.

So it’s understandable SEBI has now come down harshly because retail investors, especially the public, don’t usually understand these risks.

There are concerns of cybersecurity and other frauds as well. Earlier this year, hackers breached the Aditya Birla Capital Digital (ABCD) app and siphoned off nearly INR 1.95 Cr worth of digital gold from 435 accounts. However, later the recovery of the entire amount was made to all customers.

In another case, two men with alleged Chinese links were arrested in Delhi for defrauding a retired Army officer of INR 41.45 lakh through fake digital-gold trading schemes.

“These incidents highlight the vulnerabilities that come with operating in an unregulated space: from cyberattacks and fraud to murky accountability in the event of loss,” another analyst in the investment advisory space added.

While most legitimate fintech platforms partner with authorised bullion providers like MMTC–PAMP or SafeGold ensuring that the gold is physically backed and stored in insured vaults, not every player in the market meets these standards.

“The real concern lies with smaller, lesser-known apps offering digital gold saving plans or gold-like products without proper licensing, audits, or clear disclosure of where the gold is held,” an RBI executive said on the condition of anonymity.

According to the RBI officials, regulators are also worried about anti–money laundering compliance such as KYC and source of funds.

Hence, the sector urgently needs standardisation, perhaps through the disclosure model used in digital lending. Such a statement would clearly outline where the gold is stored, what fees apply, what the redemption options are, and whether insurance coverage exists.

“Today, most of this information is buried deep in terms and conditions, leaving even savvy investors to navigate dense legal jargon,” the fintech founder quoted above added.

Ultimately, SEBI’s warning is a reality check for a market that has scaled faster than its rulebook. Digital gold has made investing simpler and more accessible, but convenience can’t substitute for regulatory clarity.

Industry experts believe that digital gold isn’t going away entirely, at least not yet. If a more regulated form of digital gold comes into the picture, platforms could act as on-ramps, helping small investors transition from informal gold savings to compliant, traceable investments.

But that future hinges on regulation catching up. For now, awareness remains low, and the lines of accountability are still blurry.

The risk, as several experts point out, is that digital gold could follow the same trajectory as some other grey areas like cryptocurrencies. That experience shows that investment tech startups can grow in a regulatory vacuum, but not without hitting a ceiling.

[Edited by Nikhil Subramaniam]

The post India’s Digital Gold Rush Gets Regulatory Reality Check appeared first on Inc42 Media.

You may also like

November Social Security payment schedule announced: Who gets paid and when

SS Rajamouli unveils Priyanka Chopra's first look in Globetroter, calls her 'the woman who redefined Indian Cinema on global stage'

Sainsbury's shopper delighted by online grocery order 'lottery win'

'People of Bihar want change': Karnataka Dy CM Shivakumar says doesn't believe exit polls predicting NDA win

Assam: Heroin valued at Rs 4.65 crore seized in Silchar